Calculator User Manual

Table Of Contents

- Contents

- Features

- A Look at Your Calculator

- Operation

- Care

- Replacing the Battery

- 1. Use a Phillips screwdriver to remove the two screws on the back of the calculator, then pull apart the front and back case halves.

- 2. Slide the battery toward the open end of the holder to remove it.

- 3. Insert the new battery with the positive (+) side facing up.

- 4. Snap the case halves back together.

- 5. Reinsert and tighten the screws.

- Replacing the Battery

- Specifications

8

Operation

The Gross Profit Margin (GPM) is the

percentage of the sales price that is

profit.

Price – Cost

––––––––––– × 100 = GPM

Price

Example 1: What is the original cost

of an item selling for $200 with a

gross profit margin of 33%? What is

the profit?

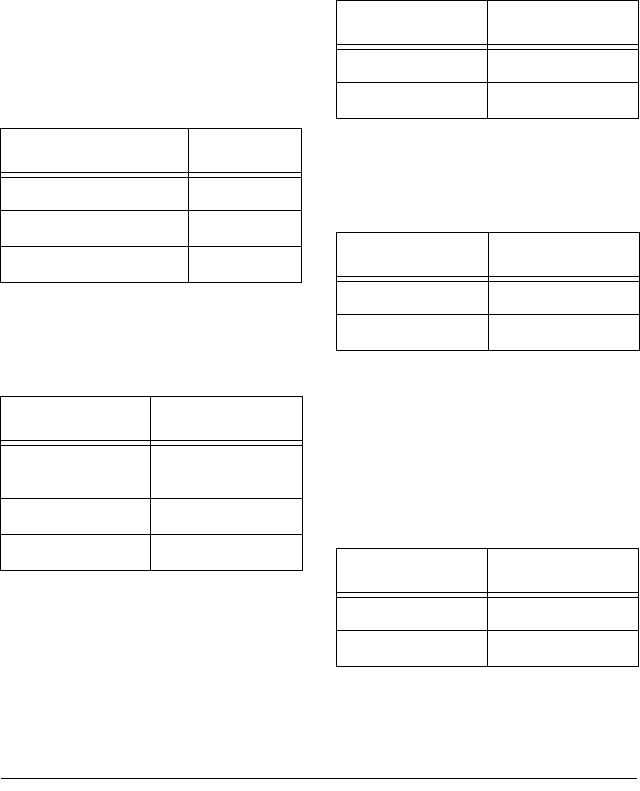

You Press You See

200 M+ × 33 +/– MU M 134

M– M 134

MR M 66.

Example 2: What is the gross profit

margin of an item costing $100 that

sells for $150? What is the profit?

You Press You See

100 M+ – 150

MU

M –

33.3333333333

150 M– M 150

MR M –50.

Note: Disregard the minus (–) signs

and read the gross profit margin as

33.3333333333% and the profit as

$50.

You can also easily calculate an

item’s discounted selling price, an

item’s final price with sales tax, and

the profit.

Example 3: What is the final price of

an item costing $70 with 5% sales

tax? How much is the sales tax?

You Press You See

70 × 5 MU 73.5

– 70 = GT 3.5

Example 4: What is the final price of

an item selling for $70 marked down

25%? How much is the discount?

You Press You See

70 × 25 +/– MU 52.5

– 70 = GT –17.5

Note: Disregard the minus (–) sign

and read the discount as $17.5.

Example 5: Calculate the selling

price of an item costing $100 with a

50% gross profit margin. What is the

profit?

You Press You See

100 ÷ 50 MU 200

– 100 = GT 100

Note: You cannot use the MU func-

tion when F 0 2 3 4 A is switched to A,