User Manual

Table Of Contents

- Important Information

- Overview of Calculator Operations

- Turning On the Calculator

- Turning Off the Calculator

- Selecting 2nd Functions

- Reading the Display

- Setting Calculator Formats

- Resetting the Calculator

- Clearing Calculator Entries and Memories

- Correcting Entry Errors

- Math Operations

- Memory Operations

- Calculations Using Constants

- Last Answer Feature

- Using Worksheets: Tools for Financial Solutions

- Time-Value-of-Money and Amortization Worksheets

- TVM and Amortization Worksheet Variables

- Using the TVM and Amortization Variables

- Resetting the TVM and Amortization Worksheet Variables

- Clearing the Unused Variable

- Entering Positive and Negative Values for Outflows and Inflows

- Entering Values for I/Y, P/Y, and C/Y

- Specifying Payments Due With Annuities

- Updating P1 and P2

- Different Values for BAL and FV

- Entering, Recalling, and Computing TVM Values

- Using [xP/Y] to Calculate a Value for N

- Entering Cash Inflows and Outflows

- Generating an Amortization Schedule

- Example: Computing Basic Loan Interest

- Examples: Computing Basic Loan Payments

- Examples: Computing Value in Savings

- Example: Computing Present Value in Annuities

- Example: Computing Perpetual Annuities

- Example: Computing Present Value of Variable Cash Flows

- Example: Computing Present Value of a Lease With Residual Value

- Example: Computing Other Monthly Payments

- Example: Saving With Monthly Deposits

- Example: Computing Amount to Borrow and Down Payment

- Example: Computing Regular Deposits for a Specified Future Amount

- Example: Computing Payments and Generating an Amortization Schedule

- Example: Computing Payment, Interest, and Loan Balance After a Specified Payment

- TVM and Amortization Worksheet Variables

- Cash Flow Worksheet

- Bond Worksheet

- Depreciation Worksheet

- Statistics Worksheet

- Other Worksheets

- APPENDIX - Reference Information

Time-Value-of-Money and Amortization Worksheets 37

Example: Computing Regular Deposits for a

Specified Future Amount

You plan to open a savings account and deposit the same amount of

money at the beginning of each month. In 10 years, you want to have

$25,000 in the account.

How much should you deposit if the annual interest rate is 0.5% with

quarterly compounding?

Note:

Because C/Y (compounding periods per year) is automatically set

to equal

P/Y (payments per year), you must change the C/Y value.

Answer: You must make monthly deposits of $203.13.

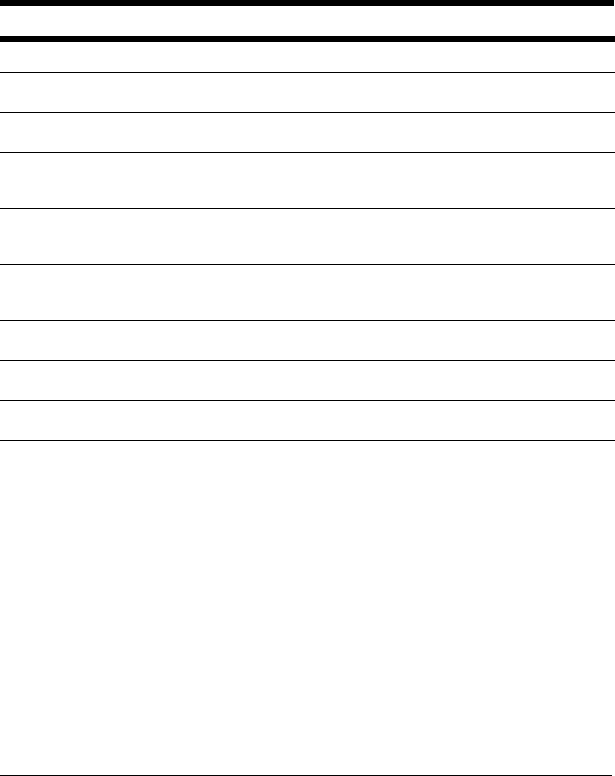

To Press Display

Set all variables to defaults. &}!

RST 0.00

Set payments per year to 12. &[12 !

P/Y=

12.00

1

Set compounding periods to 4. # 4 !

C/Y=

4.00

1

Set beginning-of-period

payments.

&] &V

BGN

Return to standard-calculator

mode.

&U

0.00

Enter number of deposits using

payment multiplier.

10 &Z,

N=

120.00

1

Enter interest rate. .5 -

I/Y=

0.50

1

Enter future value. 25,000 0

FV=

25,000.00

1

Compute deposit amount.

C /

PMT=

-203.13

7